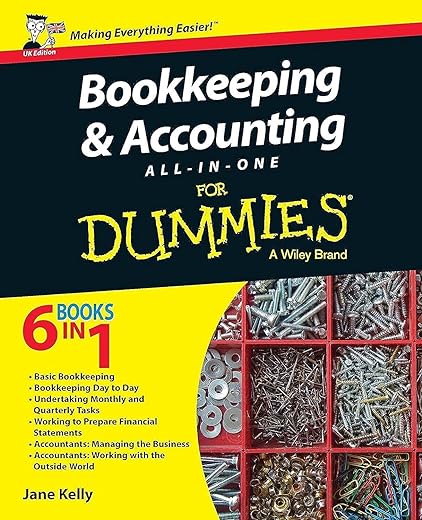

Bookkeeping and Accounting All-in-One For Dummies – UK, UK Edition

£16.00£23.70 (-32%)

Unless you’re one of those rare “numbers people,” the thought of accounting and bookkeeping probably make your head spin. While these pragmatic and confusing practices may not be fun for the rest of us, mastering them is absolutely essential in order to run and maintain a successful business. Thankfully, Bookkeeping & Accounting All-in-One For Dummies, UK Edition, is here to take the intimidation out of crunching numbers and offers easy-to-follow, step-by-step instruction on keeping your business’ finances in order with information specific to a business in the United Kingdom.

Written in plain English and packed with loads of helpful instruction, this approachable and all-encompassing guide arms you with everything you need to get up and running on all the latest accounting practices and bookkeeping software. Inside, you’ll find out how to prepare financial statements, balance your books, keep the tax inspector off your back, and so much more.

- Gives you access to supplemental online samples of bookkeeping forms, accounting templates, and spreadsheets

- Includes many practical bookkeeping and accounting exercises and templates

- Simplifies every aspect of accounting and record-keeping

- Shows you how to run your business “by the books”

If you’re a small business owner or employee who is confused and intimidated by managing your accounts and books, this comprehensive guide empowers you to take charge of those pesky figures to keep your business afloat.

Read more

Additional information

| Publisher | For Dummies, UK edition (29 May 2015) |

|---|---|

| Language | English |

| Paperback | 488 pages |

| ISBN-10 | 1119026539 |

| ISBN-13 | 978-1119026532 |

| Dimensions | 18.29 x 2.79 x 22.86 cm |

by Diego T.

The book is a bit outdated, but it explains the basics quite well.

by C Owen

Book arrived in pretty good condition however as with a previous book there were what looked like food markings on it so have to clean and disinfect.

by Amazon Customer

This book says what it is for. Even though I’ve done a year at college learning this stuff this book gives you exercises to practice. Simple and clear

by Katie85

I purchased this book because I had been given an ‘acting-up role’ at work to cover for my colleague in accounts who is currently on maternity leave and was suddenly faced with either things I had not done for several years in different companies or were completely new concepts. I was taught HOW to do the new things but I wanted to know more WHY things had to be done in a certain way. Hence the decision to do some homework.

Firstly, this book had way more than what I needed, but it’s far better to have too much than not enough. I also found that some of my new jobs are ‘accounts’ based and other jobs are ‘bookkeeping’ based so was definitely worth investing in the all-in-one version. The book is comprehensive and gives clear diagrams and examples so concepts become easier to understand. Each chapter has ‘have a go’ questions to test your knowledge. It is the UK edition, so whilst it covers things like VAT and minimum wage, it is worth noting that legislation changes overtime (the minimum wage figures quoted in the book are a few years out of date), so this book will need to be used in conjunction with other materials if you are a small business owner, accounts manager or sole bookkeeper at your workplace.

I wasn’t sure how I felt about the book to start with, as I found book 1 to be slightly overwhelming, it is almost a summary of what to expect in the following books which will then explain things in more detail. However I did find that through reading further into the book that the first section did make more sense on a second attempt. I was particularly impressed by the fact that it recognised that retail/service/manufacturing companies are all different and do need to do certain processes like cost pricing differently. Of course, I have only really read ‘my area’ in detail, but it is good to know the rest for future reference.

Overall, I have found it to be a good source of information and it has been helping me in my current role – the managing director has noted that I seem more confident in my work and I think a part of that is down to the book as I am now understanding why I am doing things instead of doing these tasks on autopilot. It has also made me consider doing an AAT qualification in the future, so I defintely recommend it as a starting guide.

by Mr J Hamilton

I’m working my way through this book, and while I think the overall explanations are good, I was disappointed to find that the examples given are using Sage 50. This is fine if you’re using Sage, or are planning on paying for that or similar products, but if you’re starting out and want to use spreadsheets until you can justify the costs, then I suggest you go and find another book. I was annoyed that the use of Sage 50 is not mentioned in the Amazon description, or on the back of the book. It’s only when you start to read it that you find out.

by Dan B.

I had to learn this as part of my job.

I’ve never enjoyed accountancy but this book, like all of them, made it easy to understand.

A very familiar branding and it doesn’t disappoint.

by WAYNE CAMERON

Excellent purchase…

by Amazon Customer

Couldn’t wrap my head around accountancy classes, however once I ordered the book, it was laid out in a way that made it easier to understand my coursework.