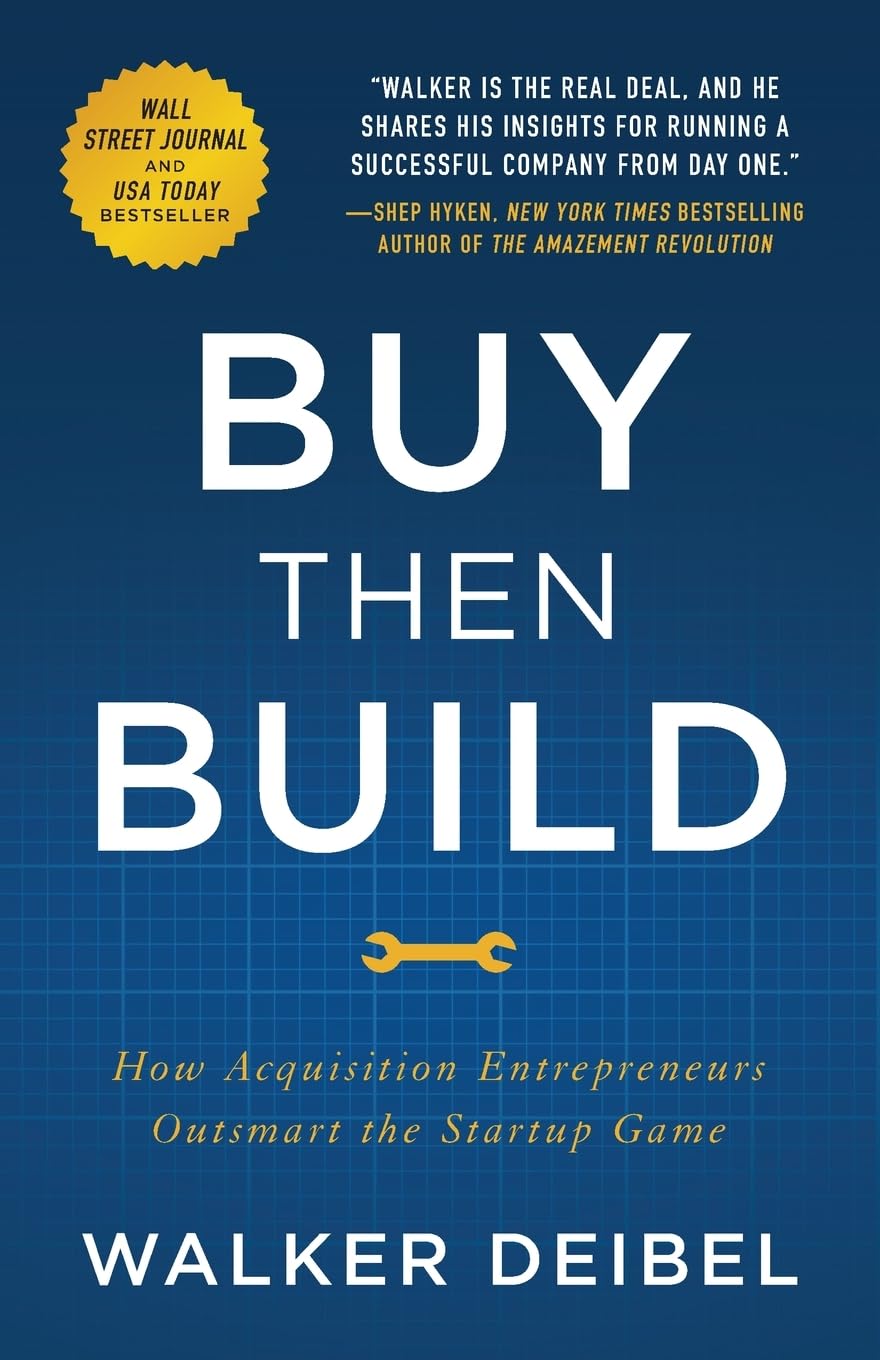

Buy Then Build: How Acquisition Entrepreneurs Outsmart the Startup Game

£12.80

Entrepreneurs have a problem: startups. Almost all startups either fail or never truly reach a sustainable size. Despite the popularity of entrepreneurship, we haven’t engineered a better way to start. …Until now.What if you could skip the startup phase and generate profitable revenue on day one?In Buy Then Build, acquisition entrepreneur Walker Deibel shows you how to begin with a sustainable, profitable company and grow from there. You’ll learn how to: ● Buy an existing company rather than starting from scratch● Use ownership as a path to financial independence● Spend a fraction of the time raising capital● Find great brokers, generate your own “deal flow,” and see new listings early● Uncover the best opportunities and biggest risks of any company● Navigate the acquisition process● Become a successful acquisition entrepreneur● And moreBuy Then Build is your guide to outsmart the startup game, live the entrepreneurial lifestyle, and reap the financial rewards of ownership now.

Read more

Additional information

| Publisher | Lioncrest Publishing (20 Oct. 2018) |

|---|---|

| Language | English |

| Paperback | 310 pages |

| ISBN-10 | 1544501137 |

| ISBN-13 | 978-1544501130 |

| Dimensions | 13.97 x 1.98 x 21.59 cm |

by Amazon Customer

Books on the topic of search funds and acquisition entrepreneurship are few and far between, so finding this book was a lucky stroke. It was recommended by a friend who is considering launching a search fund, and we both find the book incredibly practical. The examples are mostly from the US, but the wider insights and terminology can definitely be applied at an international scale. It’s also full of specific examples of successful acquisitions, which adds to the already strong credibility from the author.

One of the best books I’ve read this year, I fully recommend it!

by Amazon Customer

Very easy to read at a surprisingly fast pace as it’s interesting and flows well. Good level of teaching knowledge, right on point for what I’m looking for.

One problem, my pet hate is over use of acronyms and this book is riddled with them. Not too bad if there’s a glossary but there isn’t!!!

Next edition needs a glossary of terms which is key to widening acceptance beyond business masters students.

by Neyirp Segol

Some useful information here, particularly for people completely new to business. 3 stars because I doubt the book was proof-read, it contains way too many grammatical errors. Also, I wish the author went into more detail in how to find target companies in practice and spent some time discussing the details of acquisitions/exits he has been involved with. A lot of the content appears theoretical which you can learn from any half decent business course.

by Ono

A great book that outlines another way of launching ones career as an entrepreneur, rather than just starting from scratch. Strategies of buying up different companies are extremely useful and most importantly this book is practical. Grab a copy, read it, action it!

by Paul Simister

Can you succeed by buying a business?

As a business advisor and coach, I have no doubt that management skills are transferrable across businesses and different trades and industries. However I usually work with business owners who have plenty of detailed knowledge of their own industry and I think this is vital. There is a balance to bringing in fresh eyes and new business ideas and combining them with deep knowledge of the customers and capabilities involved.

If I had my time again, I like to think I’d buy businesses, improve them and either sell them again or keep them if I found the trade interesting .

Indeed, for many years I described myself as a “frustrated entrepreneur” who was on the lookout for an opportunity but I wanted something where I had a deep passion. I never found anything and an assessment (Kolbe) showed me I was more a business architect than builder. I got my kicks from thinking about a business conceptually. The advisor role suits me because I don’t feel a need to take control and make the decisions.

Is buying a business with the intention of building it into something bigger and better right for you?

To quote from the book…

“You need to commit your time to taking action. You need to commit to investing your own money and betting on yourself. You need to be willing to create a business plan and pitch it to banks or other potential investors. Finally, you need to be comfortable and willing to take calculated risks.”

The book provides the roadmap to guide you.

I was pleased by this quote

“For the acquisition entrepreneur to find the right company and have success running it, they too need to have all three attributes working in harmony: Attitude, Aptitude, and Action.”

This is the essential foundation. It is not simple and it is not for everyone. One of the big surprises in store for a new start-up entrepreneur is how much he or she has to learn about so many different topics. It can feel overwhelming. But the start-up has the advantage of starting slowly. The acquisition entrepreneur is thrown in at the deep-end.

The book goes into detail about having the right attitude and aptitude and action refers to finding an opportunity where the actions needed suit your preferences. It’s obvious but who wants to do work they hate?

There is a guidance about how to put together the deal and due diligence but professional advice is essential.

After that, the book looks at what you do in your first few months as the new owner. This is sensible but priorities will depend on the situation. A turnaround requires earlier fundamental changes than a business where you expect to make incremental growth.

Criticism and Concerns

*************************

1) I felt the author was selling the idea hard. The claimed 98% success rate is spurious and especially when compared against the abysmal failure rates of start-ups. Big companies have a dreadful record with acquisitions.

2) The book indicates that if you invest 10, you can borrow 90, meaning you can buy a business for 100. This seems very optimistic to me for the UK and is based on what the SBA will do in the USA.

3) I feel the importance of experience is underplayed. Switching to new customer markets and operating capabilities together is risky and is why diversification often fails.

4) I’d like to see more emphasis on risk management.

Conclusion

***********

Buying a business isn’t new. It’s long been a way for people to step into business ownership.

Instead of starting with a blank sheet and inventing, you take a business and adapt it.

I like this book and was torn between 4 and 5 stars. I may be back to upgrade it.

Paul Simister helps frustrated business owners who are stuck get unstuck.

by Jemma Bateman-Harlow

I just started reading and its such an eye opener to a new way of thinking and executing business. Remarkable.

by Andrew Holt

I don’t ever leave reviews but felt compelled to do so!

As an entrepreneur myself who has built several businesses and experienced the pitfalls of building said businesses, this book is a sheer revelation!

I feel it’s truly a MUST. An invaluable tool for the modern entrepreneur who wants to succeed PLUS an enjoyable read!

by Okenna

A step by step guide to help you to acquire your business! Follow each step as each one matters! Then quickly go to action!!!