Recommended Items

-

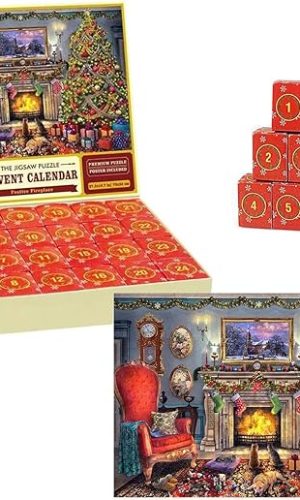

Christmas Advent Calendar 2023 Jigsaw Puzzle | 1000 Piece Jigsaw Puzzle for Adults | Gift for Women, Men, Kids | Countdown To Christmas Home Decoration

- Challenging Countdown Puzzle: Experience the thrill of solving a 24-day Christmas puzzle! Add a new piece each day, starting from the bottom right corner. Complete it on Christmas Eve for a satisfying finish.

- Safe & High-Quality Materials: Our puzzle is made from recyclable cardboard with non-toxic ink treatment, ensuring safety and durability. The precision-cut pieces fit snugly together, providing a seamless puzzle experience.

- Family Bonding & Entertainment: Bring your family together with this engaging advent calendar puzzle. Enjoy the satisfaction of teamwork as you complete the puzzle. Extra number patterns on the back of the pieces help you solve it faster.

- Timeless Christmas Gift: This 1000-piece puzzle is a perfect Christmas gift for adults, teenagers, and puzzle enthusiasts. Beautifully boxed, it adds excitement to the holiday season and creates lasting memories.

- Stunning Christmas Decoration: Once completed, the puzzle transforms into a charming “Holiday Mantel” scene. Frame it and hang it on your wall to enhance your home decor and create a warm festive atmosphere. If you have any questions, please feel free to contact us!

£9,692,888,480,767,450.00 -

Jigsaw Advent Calendar 2023, Puzzle Advent Calendar Jigsaw 2023 for Adults 1000 Piece Christmas Countdown Calendar Gifts for Women Men Teens Kids (A)

- Christmas Countdown with 24-Day Jigsaw Puzzle Calendar: Our unique Jigsaw Advent Calendar 2023 adds a delightful twist to your festive preparations. Starting with the 24th piece in reverse order, each day unveils a new puzzle piece, creating an exciting and challenging countdown to Christmas. The final piece on Christmas Eve completes the entire Christmas puzzle.

- Quality and Safety Assured: Inside the package, you’ll find a generous 70*50CM/27.6” x 19.7” large Christmas puzzle, a 1:1 reference poster, and a handy puzzle card. Crafted from eco-friendly cardboard and treated with safe, non-toxic ink, the puzzle boasts high quality and matte finish, ensuring it won’t glare or fade. Precision-cut pieces fit snugly together with smooth, burr-free edges for a satisfying experience.

- Family Fun: Our Advent calendar puzzles are designed to be entertaining challenges that bring families together. Completing a Christmas puzzle is a source of pride, achieved through family cooperation. Say goodbye to frustration with added number patterns on the back of puzzle pieces, corresponding to those on the poster, to expedite your puzzle-building journey.

- Festive Gift Delight: The 1000 Piece Christmas Jigsaw Puzzle isn’t just a puzzle; it’s a timeless entertainment game. Packaged beautifully, it’s the perfect Christmas gift for adults, teenagers, couples, and parents, adding an extra layer of excitement to your Christmas countdown in 2023.

- Charming Christmas Decor: Once your puzzle is complete, it transforms into a heartwarming “Holiday Mantel” scene. Frame it and hang it on your wall to enhance your home’s beauty and warmth during the holiday season. If you have any questions, please don’t hesitate to get in touch with us!

£9,692,888,480,767,450.00 -

Elf 24 Day Kit, 2023 Elf Kit 24 Days of Christmas, Props, Xmas Countdown Advent Calendar Elf Accessories Cartoon Box Toys, Christmas Party Gifts for Kids Teens Boys Girls

- Christmas Elf Adventure Begins: Elevate the festive spirit at home with our 24-Day Kit! Embark on a delightful Christmas journey with the entire family using this charming Christmas elf kit.

- Daily Surprises Await: Unbox the joy of stress-free and super-fun December days with our Kit. Each morning, witness the excitement as your kids discover intricate and creative scenes, adding a magical touch to their countdown to Christmas.

- Countdown to Joyful Moments: Let the Elf Advent Calendar enchant your home for 24 days of pure joy. Revel in the anticipation as your children explore complex and creative scenes each morning, making every day leading up to Christmas merry and bright.

- Versatile Festive Fun: Beyond its enchanting countdown, this Kit is designed for multifaceted festive enjoyment. Hide a fun surprise every day, count down to Christmas with your kids, and gift them an unforgettable Christmas filled with laughter and excitement. Perfect for family, friends, and kids alike.

- Christmas Pop Toys Extravaganza: These Christmas pop toys are the ideal companions for children, boys, and girls. Whether it’s for parent-child games, children’s party gifts, New Year celebrations, or adding a festive touch to Christmas scenes and decorations, our naughty props promise magical Christmas gifts for all.

£161,041.10 -

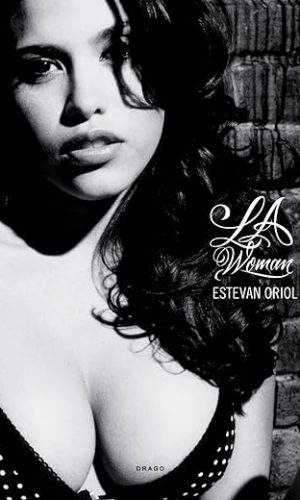

LA Woman

Estevan Oriol is hailed as the eye of the new wave Latino aesthetic. Coming up from the streets and the Hip Hop scene, his rough and ready images of his neighborhood homies caught the attention of major media and music players. Oriol has since been commissioned by Nike and Cadillac, as well as directing music videos for Eminem, Linkin Park, D12 and Xzibit. He began taking pictures of his neighborhood and low-rider culture and soon discovered his incredible talent for capturing raw street life. He is now one of the most sought after photographers in the urban community.Read more

£543.90LA Woman

£543.90 -

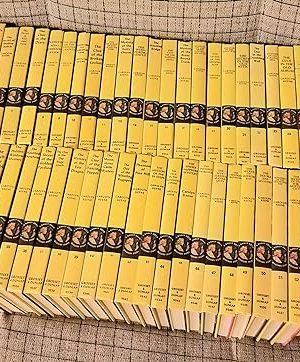

Nancy Drew Complete Set 1-56 (Nancy Drew Mystery Stories)

Nancy Drew Hardcover Set 1-56 HardcoverRead more

£539.81 -

SQE Bundle FLK 1 & 2: 3e (SQE1)

The Law & Professional Practice (FLK1 & FLK2) bundle contains all 15 study manuals that have been specially collated to focus on the Law area of the Solicitors Regulation Authority (SRA) syllabus for the Solicitors Qualifying Examination (SQE1) in a concise and tightly focused manner.

Published and updated regularly, these user-friendly study manuals are designed to help you successfully prepare for the SQE1 exams. They provide solid knowledge and understanding of fundamental legal principles and rules, while bringing the law and practice to life with example scenarios based on realistic client problems.

Each title is complemented by worked examples and sample assessment questions that enable you to test your knowledge and understanding through single best answer questions that have been modelled on the SRA’s sample assessment questions.

For students at The University of Law, the study manuals are used alongside other learning resources and the University’s assessment bank to prepare students not only for the SQE1 exams, but also for a future life in professional legal practice.

The legal principles and rules contained within this study manual are stated as at 1 April 2023 (titles with tax elements to 30 April 2023)

Titles included in this bundle:

- Business Law and Practice

- Dispute Resolution

- Contract

- Tort

- Legal System of England and Wales

- Constitutional and Administrative Law and EU Law

- Legal Services

- Property Practice

- Wills and the Administration of Estates

- Solicitors Accounts

- Land Law

- Trusts

- Criminal Law

- Criminal Practice

- Ethics and Professional Conduct

Read more

£407.80£455.90SQE Bundle FLK 1 & 2: 3e (SQE1)

£407.80£455.90 -

Personal Injury Pleadings

Personal Injury Pleadings is the authoritative stand-alone source to assist the professional draftsman settling claimants and defendants statements of case. The sixth edition deals with contemporary challenges in litigation as diverse and demanding as the requirements for pleadings in fundamentally dishonest QOCS cases; relief from sanctions applications; cases involving foreign travel; the consequences of BREXIT in Personal Injury litigation; post-ERRA pleadings requirements as to breach of statutory duty; and much more. It provides informed, accurate, in-depth model pleadings, covering the whole gamut of personal injury work, drawn from many years practical experience of real cases. Comprehensive subject coverage is combined with up-to-date informed analysis of recent case law, legislation and subordinate legislation, changes in the Civil Procedure Rules, costs issues, and the minutiae of troublesome practical problems such as the special difficulties involved in fatal accident and late-onset terminal disease claims.Read more

£248.00Personal Injury Pleadings

£248.00

-

Value Pricing for Accounting Professionals: A Complete Guide for Accountants and Bookkeepers to Find the Right Clients and Increase Profitability

Accountants and bookkeepers are working long hours but not making the profits they should. A value pricing strategy can lead to better prices for accounting professionals and better results for their clients.

The concept of value pricing is simple to understand but many accountants struggle with the price conversation and lack the confidence to charge higher prices. Value Pricing for Accounting Professionals is a practical guide to building a clear pricing strategy, feeling more confident and increasing earnings. It covers the critical steps to pricing a new client and how to re-price existing clients without losing them by quantifying value.

The book’s step-by-step approach is backed up by dozens of real-life case studies of firms which applied these methods to get better results, along with benchmarking research based on a survey of thousands of accounting professionals. There is guidance on calculating a profitable price, creating effective packages and managing the ‘invisible’ cost of scope creep, and new insights into meeting clients remotely and pricing in difficult economic times. Become more profitable and deliver extraordinary solutions to clients with this essential guide to effective value pricing.

Read more

£28.50 -

AAT Management Accounting Budgeting: Question Bank

The Question Bank provides all the knowledge required for the Management Accounting: Budgeting unit. Question Banks allow students to test knowledge by putting theory into practice and refine exam technique. Features include: assessment standard practice questions and answers, guidance of revision technique, hints and tips. Our materials and online equivalents will help ensure you are ready for your assessments and prepared for your career in accounting.Read more

£14.30 -

Teach Yourself Basic Accounting New Edition (TYBU)

TEACH YOURSELF BASIC ACCOUNTING is a complete, step-by-step course in elementary accounting. It gives clear and concise explanations of accounting principles and practice including PAYE, cashflow statements, accounting for share capital, accounting standards and non-financial reporting.

No prior knowledge of book keeping or accounting is assumed. Clear explanations, diagrams and worked examples enable the student to master the basic principles then apply them to example problems.

TEACH YOURSELF BASIC ACCOUNTING covers the examination requirements of all first-level courses.

Read more

£2.70 -

Small Business Accounting Ledger: A5 (148 × 210 mm), 120 Pages | Simple Accounts, Cash Book, Bookkeeping for Small Businesses | Debit | Credit | Balance.

Keep track of your income and expenses with this accounting ledger for small businesses and organizations.

Specification

- 120 pages

- A5 format (5.8 × 8.3 inches)

- Matte cover

- Perfect bound

Headings

- Date

- Description

- Ref

- Debit

- Credit

- Balance

Read more

£3.80 -

Accounting 101: The ultimate guide to financials that every business owner should master! students, entrepreneurs, and the curious will most certainly … from learning the…

Accounting is a foundational subject matter of business. You cannot be a student of business, run your own startup, or even have a somewhat coherent conversation with someone on the topic of business if you don’t understand the basics of accounting. This is a must-read for everyone frankly. The good news is that Concise Reads has done it once again and is now offering Accounting in an easy to read, easy to understand concise read that can be read and understood within the span of a single day! Concise Reads is better than other accounting books because it’s short, it’s to the point, it’s affordable, and it’s written by the same person who brought you the popular titles on how to write a business plan, how to incorporate, operations management, and leadership principles. There is also no age limit for this reading. It would actually be a wonderful thing to gift this to anyone and everyone you care about to get them understanding the fundamentals of profits and losses, assets and liabilities, and the relationship to cash flows. Most Americans don’t even get to learn accounting by the time they finish college–just to put the potential impact in perspective.In this guide you will learn about:

- GAAP ACCOUNTING

- MASTERING JOURNAL ENTRIES

- INCOME STATEMENT

- BALANCE SHEET

- CASH FLOW STATEMENT

- STATEMENT OF RETAINED EARNINGS

- MUST KNOW COMMON ACCOUNTING TERMS

This Series covers the following topics commonly taught in MBA programs:

- ACCOUNTING 101

- HOW TO WRITE A BUSINESS PLAN

- OPERATIONS MANAGEMENT

- LEADERSHIP PRINCIPLES

- THE ART OF NEGOTIATION

- HOW TO INCORPORATE YOUR BUSINESS

- CONSULTING FRAMEWORKS

Read more

£15.30 -

Keep Calm I Have A Spreadsheet For That Funny Accountant Notebook | Spread Sheet Journal | Co-Worker & Office Worker Surprise: Colleague Novelty Gag Gift

This is a perfect gift idea for accountant, coworker, boss, office worker, employee…etc. Get your notebook that keeps telling you: “Keep Calm I Have A Spreadsheet For That”, great for all occasions for men and women who use the spread sheet constantly.- SURPRISE FOR EVERYONE: Mother, Father, Brother, Sister, Grandfather, Grandmother, Uncle, Aunt, Uncle (in law), Dad, Mom, Husband, Wife, Friend, Lover, Supervisor, Worker, Employee, Engineer, Co-worker, Company Boss, CEO, Professor, Teacher, Student…etc.

- FOR MANY OCCASIONS (MEN & WOMEN): Gifts for New Year, Halloween, Black Friday, Independence Day, Labor Day, Valentine’s Day, Secret Santa, President Day, Memorial Day, Thanksgiving, Veterans Day, Easter, Holidays, Birthday, Celebrations, Anniversary…etc.

Read more

£5.70 -

Accountants A4 Analysis Pad: Accounts Analysis Book, 8 Columns, 54 Numbered Lines, A4 Notebook, 96 Pages, 90gsm White Paper – Blue

Accountants Analysis Pad – A4

Accountants accounting analysis pads for maintaining control of financial accounts and analysis.- Accounting Analysis Pad

- Size: A4 (210 x 297mm)

- 8 Columns with 54 Lines

- 100 pages per book

- Printed double sided on high-quality 90gsm white paper.

- Durable matte finish bound cover

Read more

£5.70 -

IFRS 17 Explained: A Practical Handbook for Insurance Contract

IFRS 17 Explained: A Practical Handbook for Insurance Contracts“IFRS 17 Explained” demystifies the complex world of the International Financial Reporting Standard (IFRS) 17 for insurance contracts. This comprehensive guide offers a harmonious blend of historical context, theoretical foundations, and real-world applications, making it an indispensable resource for both novices and seasoned professionals in the insurance and accounting sectors.

Key features:

-

Holistic Overview: From the roots of IFRS standards to the profound implications of IFRS 17 in the insurance landscape.

-

Practical Approach: Detailed case studies and real-world examples offer insights into the challenges and triumphs of transitioning to IFRS 17.

-

In-depth Analysis: Each chapter delves into critical aspects of the standard, such as measurement approaches, presentation requirements, and disclosure checklists, enriched with clear explanations and illustrative figures.

-

Resourceful Appendices: A curated list of additional readings, websites, and a handy glossary ensure you’re well-equipped for deeper dives.

-

Interactive Elements: Engage actively with the content, courtesy of prompts, questions, and areas for note-taking embedded throughout.

Whether you’re an insurance professional, an accountant, a student, or just keen on understanding the future of insurance accounting, “IFRS 17 Explained” stands as your definitive guide to the intricacies of this pivotal standard.

Read more

£11.30 -

-

Financial statements for sole traders and partnerships: Workbook (Accountancy Revision Workbooks)

This workbook has been designed for students studying AAT Level 3 or similar qualifications and will guide you through the preparation of financial statements for sole traders and partnerships. It includes examples, explanations and tasks for you to complete with fully worked and explained answers.Read more

£5.00 -

Accounting in a Nutshell: Accounting for the non-specialist (CIMA Professional Handbook)

Designed primarily for middle and junior management who deal with financial information without really understanding the content; students who are studying accounting as a non-specialist subject, for example on a business studies or engineering course. The book serves as a basic reference to be used throughout the course. It will also be particularly helpful in providing the basic grounding that is required before moving on to the more technical and in-depth study of the subject that may be required on some courses. Students who are embarking on a course of study to become a professional accountant will also find this book of major benefit. In addition to revisions through out, a new new chapter ‘Making long-term investment decisions’ covering capital investment decisions, extends and rounds out the final part of the book: using Financial Information to Manage a Business. The chapter deals with the investment appraisal process and covers the main investment appraisal techniques from the point of view of a non-specialist: payback periods, accounting rate of return and discounted cash flow methods are just some of the new topics covered. The focus will be on the level of understanding that a non-specialist requires in the work place as such, in keeping with the rest of the book, the chapter includes practical examples and exercises to enhance the reader’s understanding.Read more

£29.40 -

Cambridge IGCSE™ Accounting Student’s Book (Collins Cambridge IGCSE™)

Collins Cambridge IGCSE ® Accounting Student Book provides comprehensive coverage of the Cambridge IGCSE Accounting (0452) syllabus, with in-depth content presented in a clear and easily accessible format. Written by experienced teachers, it offers a wide range of carefully developed features to help students to develop and apply their knowledge.

Exam Board: Cambridge Assessment International Education

First teaching: 2018 First examination: 2020The Student Book provides full syllabus coverage of the new IGCSE Accounting syllabus (0452) as well as the Cambridge O level syllabus (7707), both for first teaching in 2018 and first examination in 2020. With a clear structure mapped to the syllabus, chapters cover the full content of the curriculum.

The course is underpinned with the primary aim of encouraging students to engage with their own learning and all material is designed to stimulate and foster independent learning. It helps to equip students with the skills needed to carry out a variety of accounting tasks, such as calculations, completing a statement of accounts, or preparing journal entries, and to be able to analyse financial data.

Written specifically for international school students with clear language and consideration of learners’ needs, it also offers revision practice and exam preparation.

- Full syllabus coverage of the IGCSE and O level curriculum for first examination 2020

- Easy-to-use book structure with clear and consistent signposting within each unit

- Key terms and key concepts highlighted on the page and also included in a useful glossary at the end of the book

- Engaging, colourful and user-friendly layout

- Written and reviewed by experienced Accounting teachers from around the world

- Worked examples to demonstrate how a problem or question can be addressed

- Practice questions and exam-style questions to reinforce students’ understanding

- Provides opportunities for homework through project work, exercises and assessment

A Workbook and Teacher Guide is also available for this course.

This title is endorsed by Cambridge Assessment International Education.

Read more

£24.70 -

Customizable Log Book: Customize Your Log Book for Income and Expenses, Accounts, Inventory, Orders, Mileage, Vehicle Maintenance, Donations, … or Time Tracking (Matte…

Are you tired of juggling multiple log books and spreadsheets to keep track of your income and expenses, debit and credit, cash in and cash out, inventory and equipment, orders, vehicle maintenance, mileage, donations, visitors, daily activity, time, or other relevant information? Look no further than our Customizable Log Book!Our log book offers 7 empty column headers, allowing you to tailor it to fit your specific needs and organizational preferences. No more sifting through irrelevant information or struggling to fit your unique tracking requirements into pre-set categories. Whether you’re a small business owner, a freelancer, or just someone who wants to keep track of their finances, this log book is perfect for you.

Here are a few examples of Log Books you can create and the prompts to use for column headers:

- Income and Expenses Log Book: No, Date, Description, Account, Income, Expense, Total

- Accounting Ledger Book: No, Date, Description, Account, Debit, Credit, Balance

- Petty Cash Log Book: No, Date, Detail, Cash In, Cash Out, Balance

- Inventory and Equipment Log Book: No, Date, Item Description, Quantity, Price, Location, Notes

- Online Order Log Book: No, Date, Company, Order #, Item Description, Amount, Received Date

- Vehicle Maintenance Log Book: Day, Date, Description of Work Done, Mileage, Location/Company, Replacement parts, Cost

- Mileage Log Book: Date, Time, Destination, Odometer Start, Odometer End, Total Mileage, Notes

- Donation Log Book: No, Date Given, Donation, Organization/Individual, Value, Payment Method, Tax-Deductible

- Visitor Log Book: No, Date, Visitor’s Name, Reason For Visit, Time In, Time Out, Sign/Initial

- Daily Activity Log Book: Date, Time, Name, Phone Number, Subject, Follow-up Required, Initials

- Time Sheet Log Book: Day, Date, Description, Time In, Time Out, Total Hours, Notes

Features:

- Matte finish cover design

- 104 Pages

- Format: Large Size 8.5 x 11 Inches

- Printed on high-quality white paper

- Double-sided

- Non-perforated

Don’t waste any more time juggling multiple log books. Invest in our Customizable Log Book today and start streamlining your tracking process. You’ll wonder how you ever managed without it!

Read more

£6.60 -

Frank Wood’s Business Accounting Volume 1 with MyAccountingLab access card

Every year, thousands of students rely on Frank Wood’s best-selling books to help them pass their accountancy exams.

Used on a wide variety of courses in accounting and business, both at secondary and tertiary level and for those studying for professional qualifications, Business Accounting Volume 1has become the worldÂ’s best-selling textbook on bookkeeping and accounting.

With the addition of a MyAccountingLab, students using this twelfth edition will have even more support when preparing for their exams.

What is MyAccountingLab?

It is an online tutorial and assessment system that has been gaining popularity with students and instructors across the globe for over ten years. With more than 300,000 registered students in 2010 doing 4 million assignments, MyAccountingLab is the most effective and reliable learning solution for accounting available today. Features include:- A personalised study plan for each student

- Guided solutions that take students step-by-step through solving a problem

- Exam board-style questions

- An eBook for quick reference

To learn more, visit www.myaccountinglab.com

Read more

£5.00 -

Accounting Ledger Book 3 column: Simple Accounting Ledger for Bookkeeping and Small Business | Large Print Income Expense Account Recorder and Tracker Logbook

Accounting ledger bookThis Ledger is perfect for tracking and recording finances and transactions, very simple and easy to use for personal, small business or for home-based businesses.

Features:

- 110 pages Perfectly Sized at 8.5″ x 11″.

- Premuim matte cover design.

- Light weight. Easy to carry around.

- Printed on quality paper.

Read more

£4.70 -

Petty Cash Book: Daily Cash Flow Log Book For Small Business Accounting Purposes |120 Pages – large size 8.5″ x 11″ in (A4).

This petty cash log book is suitable for keeping detailed business records and tracking small cash flows. Ideal for small to medium-sized companies to document and secure all essential information in a transparent yet organized manner. Giving the constant monitoring and recording of money a sense of accountability and transparency.

Page details:

•DATE

•DETAILS

•PAYEE

•CASH IN

•CASH OUT

•BALANCE

•INITIALS

•TOTAL BALANCE

•NOTES

Features:

•120 Pages

•White paper

•Perfect size at 8.5 x 11 in / 21.59 x 27.94 cm /A4Read more

£4.10 -

ICAEW Accounting: Passcards

BPP Learning Media’s unique Passcards make the best use of your revision time. They summarise key topics to jog your memory and are packed with exam and assessment targeted guidance. Their innovative card format helps you revise at a glance. They are part of a market leading suite of materials BPP Learning Media has produced to help support students.Read more

£10.30ICAEW Accounting: Passcards

£10.30 -

Household Accounting Ledger: Large Format / Easy Read, Simple Debit and Credit Home Accounts Book

Track your household’s income and expenses with this larger format (210 × 297 mm) ledger with bigger headings (12 pt) for ease of reading.

Specification

- 100 pages

- A4 format (8.3 × 11.7 inches)

- Soft, matte cover

- Perfect bound

Headings

- Blank

- Date

- Details

- Debit

- Credit

- Balance

Read more

£4.70 -

Accounting Ledger Book: Large Simple Accounting Ledger Book for Bookkeeping and Small Business Income and Expense Recorder Journal – 100 Pages – Income Expense Account Notebook

Simple Accounting Ledger – perfect for tracking income and expenses. Suitable for personal, small business or home-based businesses.You can annotate the Ledger number on the Cover of the book for easy future reference.

Each page has an area to note down the Starting Balance.

Transitions capture columns include:

- Entry #No

- Date

- Account

- Description

- Payment (Debit – )

- Deposit (Credit +)

- Balance

Plus there is additional space at the bottom of each page to capture further important notes.

Large size and clear layout make it easy to write down.

Maintain accurate business records, keep track of your finances and transactions.

Large 8.5” x 11” size format workbook. 100 pages , 30 Rows per page (50 double sided sheets)

Perfect size – Not too large or too small, this design will easily fit in a standard backpack or briefcase.

Printed on white paper

Matte finished coverRead more

£6.60 -

Accounting Guide For Complete Beginners: Grasping Essential Concepts with Ease | Navigating the World of-Accounting-and Adjusting Entries

“Accounting Guide For Complete Beginners” is your key to unraveling the mysteries of accounting with simplicity and clarity. Whether you’re a small business owner, a student, or simply someone curious about the world of finance, this book provides a straightforward path to understanding fundamental accounting concepts.

Your Accounting Journey Begins Here: This comprehensive guide starts from scratch, ensuring that even those with no prior knowledge of accounting can grasp its principles quickly and effortlessly.

Demystifying Financial Statements: Financial statements don’t have to be intimidating. “Accounting Guide For Complete Beginners” breaks them down into digestible pieces, making it easy for you to understand and interpret them with confidence.

Mastering Adjusting Entries: Adjusting entries are a crucial part of the accounting process, and this book makes them crystal clear. You’ll learn how to ensure your financial records accurately reflect the financial health of your small business.

A Valuable Resource for Small Business Owners: Running a small business comes with its own set of financial challenges. “Accounting Guide For Complete Beginners” equips you with the knowledge and skills needed to manage your finances effectively, enabling your business to thrive.

Practical Examples and Exercises: Reinforce your learning with practical examples and exercises that allow you to apply what you’ve learned. These hands-on activities make accounting principles come to life.

Clarity and Confidence: By the time you finish “Accounting Guide For Complete Beginners,” you’ll have the clarity and confidence to tackle accounting tasks and make informed financial decisions.

Your Journey to Financial Literacy Starts Now: Are you ready to demystify accounting, master financial statements, and become proficient in adjusting entries? “Accounting Guide For Complete Beginners” is your guide to achieving these goals. Take action now and add this invaluable resource to your collection.

Empower yourself with financial knowledge and make informed decisions for your small business or academic pursuits. Buy your copy of “Accounting Guide For Complete Beginners” today and embark on a journey to accounting mastery. Don’t wait—grab your book now and transform your understanding of basic accounting principles.

Read more

£10.10 -

MANAGEMENT ACCOUNTING TECHNIQUES WORKBOOK

Comments – New Store StockBecause we have over 2 million items for sale, we have to use stock images, not actual images of the items for sale. Unless explicitly mentioned in this listing, the purchase of this specific item is made with the understanding that the image is a stock image and not the actual item for sale. For example, some of our stock images include stickers, labels, price tags, hyper stickers, obi’s, promotional messages, and or writing on the sleeve or disk label. When possible we will add details of the items we are selling to help buyers know what is included in the item for sale. The details are provided automatically from our central master database and can sometimes be wrong. Books are released in many editions and variations, such as standard edition, re-issue, not for sale, promotional, special edition, limited edition, and many other editions and versions. The Book you receive could be any of these editions or variations. If you are looking for a specific edition or version please contact us to verify what we are selling. Christmas Gift Ideas This is a great gift idea. Hours of Service We have many warehouses, some of the warehouses process orders seven days a week, but the Administration Support Staff are located at a head office location, outside of the warehouses, and typically work only Monday to Friday. Contact Us Please contact us to check and verify the details of the item before purchasing if there is a specific image, edition, or variation you are looking for. If we have resources available we will share images. Location ID 245ziHaveit SKU ID 149897405Unique Reference Number 1999107144Read more

£15.20 -

I Love Accounting, It Makes People Cry: Accountant Blank Lined Journal Notebook Diary

Embrace the Digits: Our accountant-inspired blank lined journal pays tribute to the often overlooked heroes of finance! Infused with humor and a sprinkle of professionalism, its design highlights keywords such as accounting, taxation, auditing, and more. Whether you’re a CPA deciphering figures or a financial maestro reconciling accounts, carry this journal with confidence as you navigate ledgers, conquer tax puzzles, and transform spreadsheets into masterpieces. Declare to the world that you’re the financial virtuoso they can rely on!Read more

£10.60 -

ICAEW Principles of Taxation: Passcards

BPP Learning Media’s unique Passcards make the best use of your revision time. They summarise key topics to jog your memory and are packed with exam and assessment targeted guidance. Their innovative card format helps you revise at a glance. They are part of a market leading suite of materials BPP Learning Media has produced to help support students.Read more

£10.30 -

Sole Trader Accounting – A Complete Bookkeeping Training Kit

This is a kit that includes (via email) A4 sized pages of all the forms you need to practice ‘doing the books’ along with either the kindle or pocket print edition. A larger print version is also available and kindle illustrations are all ‘pinchable’. Learn how to complete your own sole trader “Books” using this hands-on guide and save money on accountant’s fees. Updated tax rates and QuickBooks. HMRC encourage sole traders to DIY and use their ‘simplified accounts’ system taught in this kit so no need for complex ‘Dummies Accounting” double entry accounting systems, charts of accounts, inventory records, balance sheets, cash flow statements, asset registers, ledgers, accruals or prepayments. You learn with a hands on case study and set of transaction records covering sales income, purchases, simple HMRC home and vehicle use rates, telephone and broadband, stationery, postage and ebay plus paypal costs (and money saving tips) if you sell online. How to fill in your annual tax form with three easy figures from your ‘books’. How to use your personal bank statement and a credit card to save money on bank costs. Learn the case study methods and then do your own business ‘books’. All the necessary ‘books’ forms are provided plus extra digital resources (email the author) including copies of all case study files (including blanks for your own business) and – if you want to progress beyond paper ‘books’ – an automated spreadsheet that allows latest profit to be immediately seen after every one of your own business transactions. A break even calculator spreadsheet is also available free and a master class in records keeping. Available as a Kindle or larger print paperback book.Read more

£8.50 -

Preparing Financial Statements: Quiz Book (Accountancy Revision Workbooks)

100 quiz questions with answers to help with revision for Level 3 Preparing Financial Statements.Read more

£5.00 -

Principles of Bookkeeping Controls: AAT Level 2 Q2022 Study Guide (AAT Level 2 Q2022 Study Guides)

A complete study guide for the Principles of Bookkeeping Controls unit part of the AAT Level 2 Certificate in Accounting, according to the Q2022 standard, in operation from 1st September 2022.Written by an accountancy lecturer and AAT-qualified bookkeeper, this study guide covers the key unit topics of:

- Payment methods and bank reconciliation

- The journal

- Payroll transactions

- Control account reconciliations

- The trial balance

- The suspense account

- Correction of errors

- Assessment support

Each chapter contains the key learning from the topic as well as a digital focus to make the links between manual and computerised bookkeeping, as well as a range of questions in order to practice the necessary skills to become a successful AAT-qualified bookkeeper.

The book ends with a section on assessment support, in order to prepare students for exams, as well as the answers to the earlier questions in the book.

Updated September 2023 to remove some spelling and grammatical errors.

Read more

£10.00 -

ICAEW Management Information: Passcards

BPP Learning Media’s unique Passcards make the best use of your revision time. They summarise key topics to jog your memory and are packed with exam and assessment targeted guidance. Their innovative card format helps you revise at a glance. They are part of a market leading suite of materials BPP Learning Media has produced to help support students.Read more

£10.30 -

Analysis Book: 14 Cash Columns Analysis Account Book, 96 Pages, A4 Size | Book Keeping Analysis Paper Pad – 14 Column Cash Book | Accounting Book for … Home-based, Home Office…

14 Column Analysis Book – A4

This 14 money column analysis book makes it easy to keep your accounts in order.

Ideal for manual book keeping, as well as perfect for keeping track of your accounts.

It allows you enter and organise all different transactions and accounts using this A4 sized analysis book.

The 14 cash columns spread across each double page, together with column and line numbering make it easy for you to keep records of incoming and outgoing money.

Suitable for office, small business or home-based business use.Features:

- A4 size

- 96 pages per book

- 14 cash columns across each double page spread

- 41 lines per page with column and line numbering

- Printed on high-quality 90gsm white paper

- Durable matte finish bound cover

Read more

£5.70 -

Frank Wood’s Business Accounting Volume 2

Business Accounting is the worlds best-selling textbook on bookkeeping and accounting. Now in its eleventh edition, it has become the standard introductory text for accounting students and professionals alike.

The book is used on a wide variety of courses in accounting and business, both at secondary and tertiary level and for those studying for professional qualifications. It builds on Business Accounting 1 to cover advanced aspects of financial accounting. It also covers introductory aspects of management accounting suitable for use at all levels up to and including professional foundation level courses and first-year degree courses.

Read more

£28.00£38.90Frank Wood’s Business Accounting Volume 2

£28.00£38.90 -

Revise SQE Solicitors’ Accounts: SQE1 Revision Guide 2nd ed

Up to date for the 2023 SQE1 specification, this book enables candidates for SQE1 to develop their knowledge and understanding of Solicitors’ Accounts as assessed in the SQE1 exam.Each chapter covers relevant SRA Accounts Rules and ledger entries. Readers will have the opportunity to test and improve both their subject knowledge and their ability to apply the Accounts Rules to problem scenarios, through multiple-choice questions in the style of the SQE1 assessment. This will include identification of appropriate ledger entries required for a range of transactions.

Read more

£14.30 -

AAT Financial Accounting: Preparing Financial Statements: Passcards

Our unique Passcards make the best use of your revision time. They summarise key topics in your module to jog your memory when it matters, and are packed with rapid bites of exam-relevant guidance. Revise at a glance and accelerate revision with summaries and visual aids.Read more

£7.60 -

CIMA BA2 Fundamentals of Management Accounting: Passcards

Passcards are a handy and portable revision tool. They are A6, spiral bound revision aids which students can carry to revise wherever, whenever.Read more

£9.50 -

Managerial Accounting For Dummies

The easy way to master a managerial accounting courseAre you enrolled in a managerial accounting class and finding yourself struggling? Fear not! Managerial Accounting For Dummies is the go-to study guide to help you easily master the concepts of this challenging course. You’ll discover the basic concepts, terminology, and methods to identify, measure, analyze, interpret, and communicate information in the pursuit of an organization’s goals.

Tracking to a typical managerial accounting course and packed with easy-to-understand explanations and real-life examples, Managerial Accounting For Dummies explores cost behavior, cost analysis, profit planning and control measures, accounting for decentralized operations, capital budgeting decisions, ethical challenges in managerial accounting, and much more.

- Covers the key concepts and tools needed to communicate accounting information for managerial decision-making within an organization

- Plain-English explanations of managerial accounting terminology and methods

- Tracks to a typical college-level managerial accounting course

Managerial Accounting For Dummies makes it fast and easy to grasp the concepts needed to score your highest in a managerial accounting course.

Read more

£15.60£17.10Managerial Accounting For Dummies

£15.60£17.10 -

Working in Accounting and Finance Tutorial (AAT Accounting – Level 2 Certificate in Accounting)

An essential teaching text for the AAT Level 2 Certificate in Accounting, ‘Work Effectively in Accounting and Finance’. Written in a clear, easy-to-understand style, the text is written closely to the syllabus and contains Case Studies, Key Terms, Activities and answers.Read more

£2.70 -

Accounting for M&A: Uses and Abuses of Accounting in Monitoring and Promoting Merger (Routledge Studies in Accounting)

Spending on M&A has, in aggregate, grown so fast that it has even overtaken capital expenditure on increasing and maintaining physical assets. Yet McKinsey, the leading management consultancy, reports that “Anyone who has researched merger success rates knows that roughly 70% fail”. The idea that businesses might be using huge and increasing sums of shareholders’ money for an activity that more often than not leads to failure calls into question the information on which M&A decisions are based.

This book presents statistical studies, case material, and standard-setters’ opinions on company accounting before, during, and after M&A. It documents the manipulation of annual accounts by acquirers ahead of share for share bids, biased forecasts of post-merger earnings by bidders, and devices to flatter earnings when recording the deal. It explores the challenges for standard-setters in regulating information flows during and after M&A, and for account-users wishing to learn from financial statements how a deal has affected performance.

Drawing on a wide range of international examples, this readable book is targeted not just at accounting specialists but at anyone who is comfortable reading the serious financial press, is intrigued by what is going on in the massive M&A market, and is concerned with achieving better-informed M&A. As such it might be of particular interest to business executives, lawyers, bankers, and investors involved in M&A as well as graduate students interested in researching or learning about the role of accounting in M&A.

Read more

£123.50 -

The Routledge Handbook of Public Sector Accounting (Routledge International Handbooks)

The Routledge Handbook of Public Sector Accounting explores new developments and transformations in auditing, management control, performance measurement, risk management and sustainability work in the contemporary world of the public sector and the functioning of accounting and management in that realm. It focuses on critical analysis and reflection with respect to changing risk and crisis management patterns in the public sector in the current Covid- 19 and post- Covid- 19 era, across diverse social, political and institutional settings globally.

This research-based edited book, targeted at scholars, professionals, teachers and consultants inthe fields of public sector accounting, auditing, accountability and management, offers high-level insights into the new architecture and execution of such activities in the emerging post-pandemic world. The chapters are written by leading scholars in the accounting and public administration disciplines internationally and provide important assessments, frameworks and recommendations concerning a wide variety of institutions, practices and policies with a view to addressing the many emerging societal, governmental and professional issues. Spanning theoretical, empirical and policy discussion contributions, the book’s chapters will be readily accessible to accounting, auditing and management audiences alike.

Read more

£36.80 -

AAT Level 3 Management Accounting Techniques: Study Text and Exam Practice Kit (Q2022) (AAT level 3 Q2022)

AAT Level 3 Management Accounting Techniques

Study Text and Exam Practice Kit (Q2022)This Study Text and Exam Practice Kit is produced by our expert team of AAT tutors. Our team have extensive experience teaching AAT and writing high quality study materials that enable you to focus and pass your exam. Our Study Text and Exam Practice Kits cover all aspects of the syllabus in a user friendly way and build on your understanding by including real style exam questions for you to practice.

We also sell FIVE AAT mock practice assessments for this subject. They are produced by our expert team of AAT tutors, giving real AAT exam style and standard questions that ensure the very best for exam success. All exam style questions have solutions fully explained and revision summaries are also included to revise the syllabus.

Our AAT tutors work extensively to produce study material that is first class and absolutely focused on passing your exam. We hope very much that you enjoy this product and wish you the very best for exam success! For feedback please contact our team aatlivelearning@gmail.com or safina@acornlive.com

Read more

£18.00 -

Final Accounts Preparation Tutorial (AAT Advanced Diploma in Accounting)

An essential teaching text for the AAT AQ2016 Advanced Diploma in Accounting (Level 3) Unit ‘Final Accounts Preparation’. Presented in a clear and accessible style the text is written closely to the AAT syllabus and contains Case Studies, Key Terms, Activities and answers.Read more

£18.10 -

Maths for Accounting Students: Workbook (Accountancy Revision Workbooks)

This workbook is written as a study aid for students studying bookkeeping and accountancy qualifications and do not feel confident with the maths topics. The workbook is tailored around accounting maths from Levels 1 to 3.Read more

£5.90 -

Cost Accounting For Dummies (For Dummies (Business & Personal Finance))

Take control of overhead, budgeting, and profitability with cost accounting

Cost accounting is one of the most important skills in business, and its popularity as a course in undergraduate and graduate business and management programs speaks to its usefulness. But if you’ve ever felt intimidated by the subject’s jargon or concepts, you can stop worrying. Cost accounting is for everyone!

In Cost Accounting For Dummies, you’ll be taken step-by-step through the basic and advanced topics found in a typical cost accounting class, from how to define costs and how to allocate them to products or services. You’ll learn how to determine if a capital expenditure is worth it and how to design a budget model that forecasts changes in costs based on activity levels.

Whether you’re a student in your first cost accounting course or a professional trying to get a grip on your books, you’ll benefit from:

- Simple methods to evaluate business risks and rewards

- Explanations of how to manage and control costs during periods of business change and pivots

- Descriptions of how to use cost accounting to price IT projects

Cost Accounting For Dummies is the gold standard in getting a firm grasp on the challenging and rewarding world of cost accounting.

Read more

£18.20£21.80